|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Interest-Only Mortgage Lenders: A Comprehensive ExplorationIn the vast landscape of mortgage options available to potential homebuyers, interest-only mortgages stand out as a distinctive choice, often polarizing opinions among both financial experts and laypeople alike. These loans are characterized by a unique structure where the borrower is required to pay only the interest on the mortgage for a specified initial period, typically ranging from five to ten years, before transitioning to regular principal and interest payments. But what does this mean for the average homebuyer, and who are the lenders providing these intriguing financial products? Firstly, it is crucial to understand the mechanics of an interest-only mortgage. During the initial period, the borrower’s monthly payments are significantly lower because they are not contributing towards the principal. While this may seem appealing at first glance, the catch is that the principal remains unchanged, meaning that once the interest-only period ends, the payments can increase substantially. This is where the reputation of interest-only mortgages becomes somewhat contentious. Critics argue that borrowers might find themselves unprepared for the financial shock of increased payments, potentially leading to financial strain. Despite these concerns, there are notable benefits associated with interest-only mortgages that appeal to certain types of borrowers. Primarily, they offer increased cash flow during the interest-only period, which can be advantageous for individuals who expect a significant increase in income down the line or those who wish to allocate funds towards other investments or expenses. For instance, a young professional anticipating career advancement might appreciate the reduced initial burden, using the savings to invest in education or other ventures.

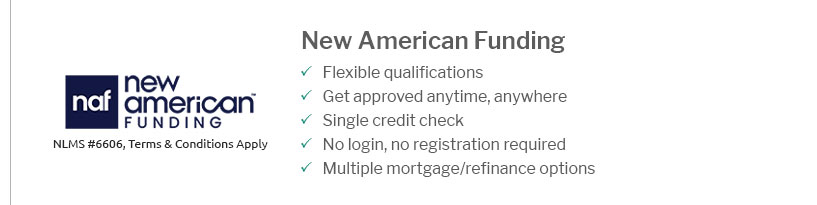

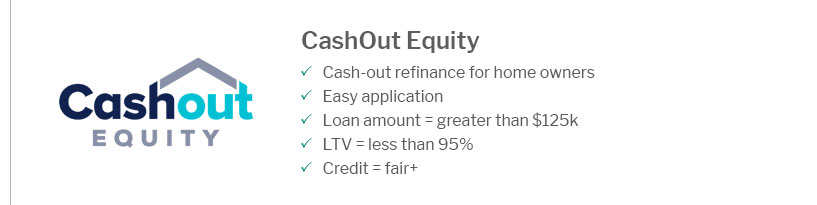

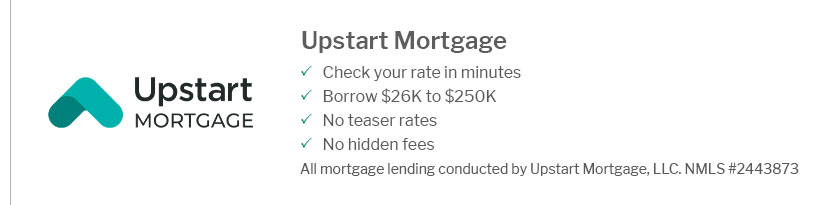

When considering lenders offering interest-only mortgages, one must approach with due diligence. Many of these lenders cater to specific borrower profiles, often requiring higher credit scores and substantial income or asset verification. Moreover, interest-only products are more common among non-traditional lenders and private financial institutions than large, mainstream banks. This exclusivity is partly due to the perceived risk associated with these loans, necessitating a more robust borrower profile to mitigate potential defaults. In conclusion, while interest-only mortgage lenders offer a product that is not without its risks, they also provide a valuable tool for those who understand its nuances and can strategically manage their finances. It is essential for prospective borrowers to thoroughly assess their financial situation and future income potential before committing to such a mortgage structure. By doing so, they can harness the benefits of an interest-only mortgage without succumbing to the pitfalls that have historically plagued this financial option. https://www.nerdwallet.com/best/mortgages/interest-only-mortgage-lenders

An interest-only mortgage is a niche product that can be difficult to find. See NerdWallet's picks for some of the best interest-only mortgage lenders in 2024. https://www.axosbank.com/personal/borrow/mortgages/interest-only-loans

An Interest-Only Mortgage is a home loan that gives you the option to pay only the interest on the principal amount for a set period of time. After the interest ... https://www.chase.com/personal/mortgage/interest-only-mortgage

Jumbo interest-only loans available up to $9.5 million. For loan amounts greater than $3MM (or for investments properties), customers must meet post-closing ...

|

|---|